Create Custom Onboarding Workflows For Any Loan Product

Lenders use Veefin LOS’ policy engine, workflows, document management, and robust integrations to approve loans faster, communicate clearly, and build trust.

Veefin Loan Origination System at a glance

No-Code Design

Business users can modify credit policies, create new loan products, and optimize processes through an intuitive visual interface.

Enterprise Digital Platform

Manage multiple loan products and business lines on one platform with centralized data.

Credit Scoring & Decisioning

Customize scorecards, risk models, and automated policy checks for precise credit decisions.

Omnichannel

Borrowers can start applications on one device and continue on another without losing progress.

Modular & Flexible

Start with core functionality and expand over time, with each component designed to integrate with your existing systems.

Your LOS, built your way

Lead Management & Acquisition

Capture leads across touchpoints, score them instantly, and route them to the right teams while giving partners real-time visibility into their referrals.

Multi-channel lead capture with AI-powered lead scoring

Intelligent routing and campaign analytics

Partner portal with real-time application tracking

Visual journey builder for customized acquisition funnels

Assisted Application Processing & Underwriting

Enable borrowers to apply anywhere with adaptive forms, instant document validation, and OCR extraction.

Credit Assessment & Decisioning

Risk teams design complex credit policies, create versioned scorecards, and leverage bureau data with Veefin's no-code decisioning platform.

Build sophisticated credit policies with drag-and-drop simplicity

Deploy scorecards that learn and improve with every application

Approve clear cases instantly with machine learning models that get smarter over time

Workflow Orchestration & Compliance

Veefin's visual workflow engine lets you design approval hierarchies, automate deviation handling, and embed compliance checks without sacrificing speed.

Visually configure workflows, rules, and processes through intuitive interfaces

Create and modify products, fields, and validations without coding skills

Implement changes in hours instead of weeks or months

Reduce dependency on third-party vendors for customizations

Platform Capabilities

Role-Based Access Control

Granular permissions ensure secure, frustration-free access. Audit trails track every action.

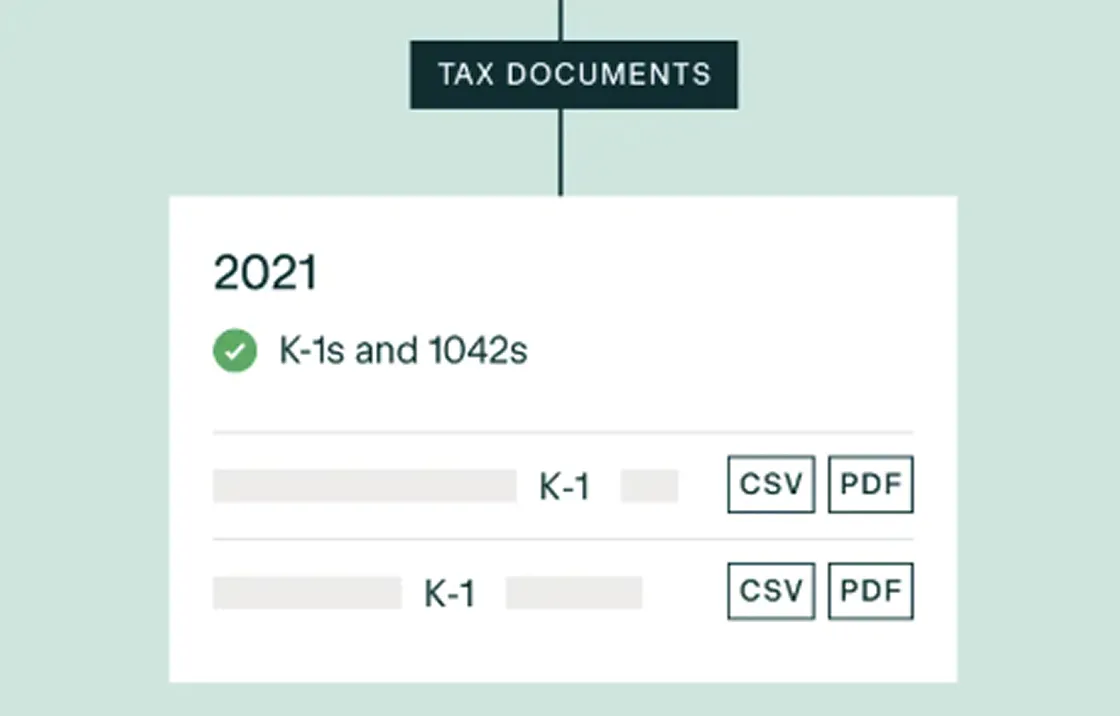

Document Management and Generation

Generate agreements and letters from templates, with secure storage, version control, and e-signatures.

Notifications

Engage customers via email, SMS, or WhatsApp with personalized, automated updates.

Reporting and analytics

Turn loan data into insights, track KPIs, and optimize processes for higher conversions.

Integration with enterprise systems

Open API architecture to build custom integrators

Complete Collateral Lifecycle Management

Our end-to-end collateral management handles everything from initial registration to final release.

Digital Collateral Registration

Unified Identification System

Cross-Collateralization Made Simple

Automated Revaluation

.webp)

Specialized Collateral Handling

Different assets require different approaches. Our system adapts to handle any collateral type with specialized workflows.

Property

Vehicles

Financial Assets

Commodities

.webp)

Build personalized onboarding journeys for 100+ loan products

.svg)

- Personal Loan

- Home Loan

- Vehicle Loan

- Credit Card

- Gold Loan

- Staff Loan

- Unsecured MSME Loans

- Loan Against Property

- Equipment Finance Loan

- Working Capital Loans

- Overdraft Line of Credit

- Revolving LOC

- Loan for shop/ factory / expansion

- Business Credit Card

- Merchant POS financing

- Commercial Vehicle Loan

.svg)

- Buy Now Pay Later

- Payday Loan

- P2P Lending

- Loan Against Mutual Funds

- Loan Against Securities

- Loan Against Fixed Deposits

Experience the

Veefin Difference

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Frequently Asked Questions

How quickly can we implement Veefin's LOS and start seeing results?

Our implementation timeline typically ranges from 8-12 weeks from contract to go-live. We use a phased approach that prioritizes quick wins while building toward full implementation. Many clients see significant improvements in processing times and completion rates within the first month after deployment.

How does Veefin's LOS integrate with our existing core banking and LMS systems?

Veefin's LOS comes with pre-built connectors for major core banking and loan management systems. Our open API architecture allows for seamless data exchange between systems, eliminating duplicate data entry and ensuring a single source of truth. We've successfully integrated with over 50 different banking systems worldwide.

Can we customize policies and workflows without relying on IT resources?

Absolutely. Our platform is designed with business users in mind. The visual rule builder and drag-and-drop workflow designer allow your credit and product teams to create and modify lending journeys, approval hierarchies, and credit policies without writing a single line of code. Changes can be tested and deployed in hours, not weeks.

How does Veefin's LOS help us manage regulatory compliance?

Compliance is built into the platform at every level. Regulatory checks are embedded directly into workflows, documentation is automatically generated to meet compliance standards, and comprehensive audit trails track every decision and modification. When regulations change, updates can be implemented quickly through the business rules engine without disrupting operations.

How does Veefin support us after implementation?

We provide comprehensive post-implementation support including 24/7 technical assistance, regular system updates, and a dedicated customer success manager. We also offer ongoing optimization services to help you continuously improve your lending processes as your business evolves. Our client retention rate of 98% reflects our commitment to long-term partnership.

What security measures does Veefin implement to protect sensitive financial data?

Veefin's LOS employs bank-grade security including end-to-end encryption, role-based access controls with granular permissions, multi-factor authentication, and comprehensive audit logging. We maintain ISO 27001 certification and SOC 2 Type II compliance, with regular penetration testing and vulnerability assessments. All customer data is stored and processed in compliance with applicable data protection regulations.

Can we white-label the customer-facing components of Veefin's LOS?

Yes, all customer-facing interfaces can be fully white-labeled with your brand, including application forms, customer portals, and communications. The platform allows for customization of colors, logos, typography, and even the overall user experience to ensure seamless brand consistency across all touchpoints.