India's First Trade Receivables Asset Class

India's pioneering securitization platform converting B2B trade receivables into institutional-grade investments.

Access a new asset class with structured risk protection and superior yields.

The Market Opportunity

India's securitization market is experiencing significant growth, yet remains just a fraction of developed markets where debt securities represent a majority of corporate debt.

Meanwhile, MSMEs forming the backbone of India's economy as a substantial portion of GDP and enterprises continue to face significant financing challenges.

Gaps We Address

How Veefin Capital Bridges the Gap

Innovative Securitization Engine

We transform trade receivables into investment-grade, credit-rated Pass-Through Certificates through a structured process.

Nationwide Distribution Network

Our platform connects originators with institutional investors across India. Banks, NBFCs, mutual funds, and HNIs.

Our platform enables

Seamless nationwide access

Single-point connectivity

Market reach expansion

Scale without infrastructure investment

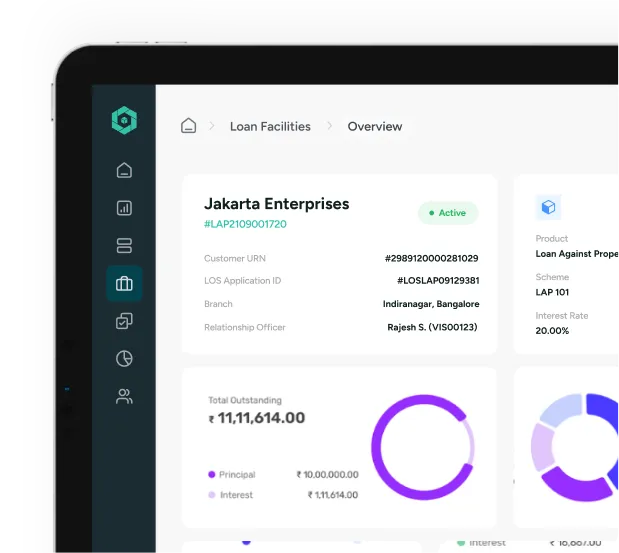

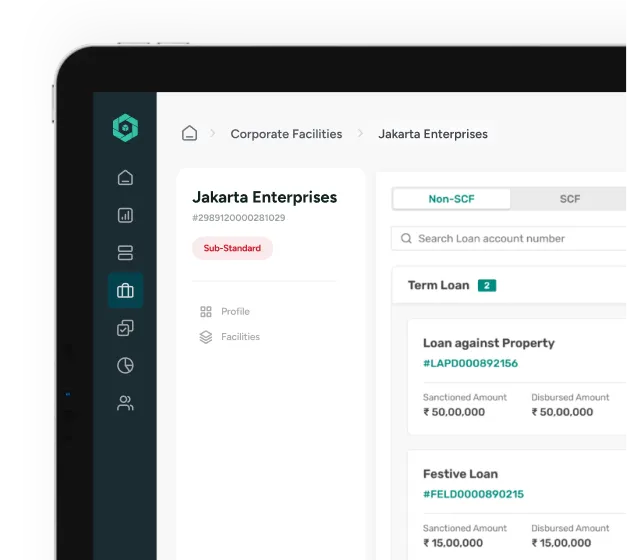

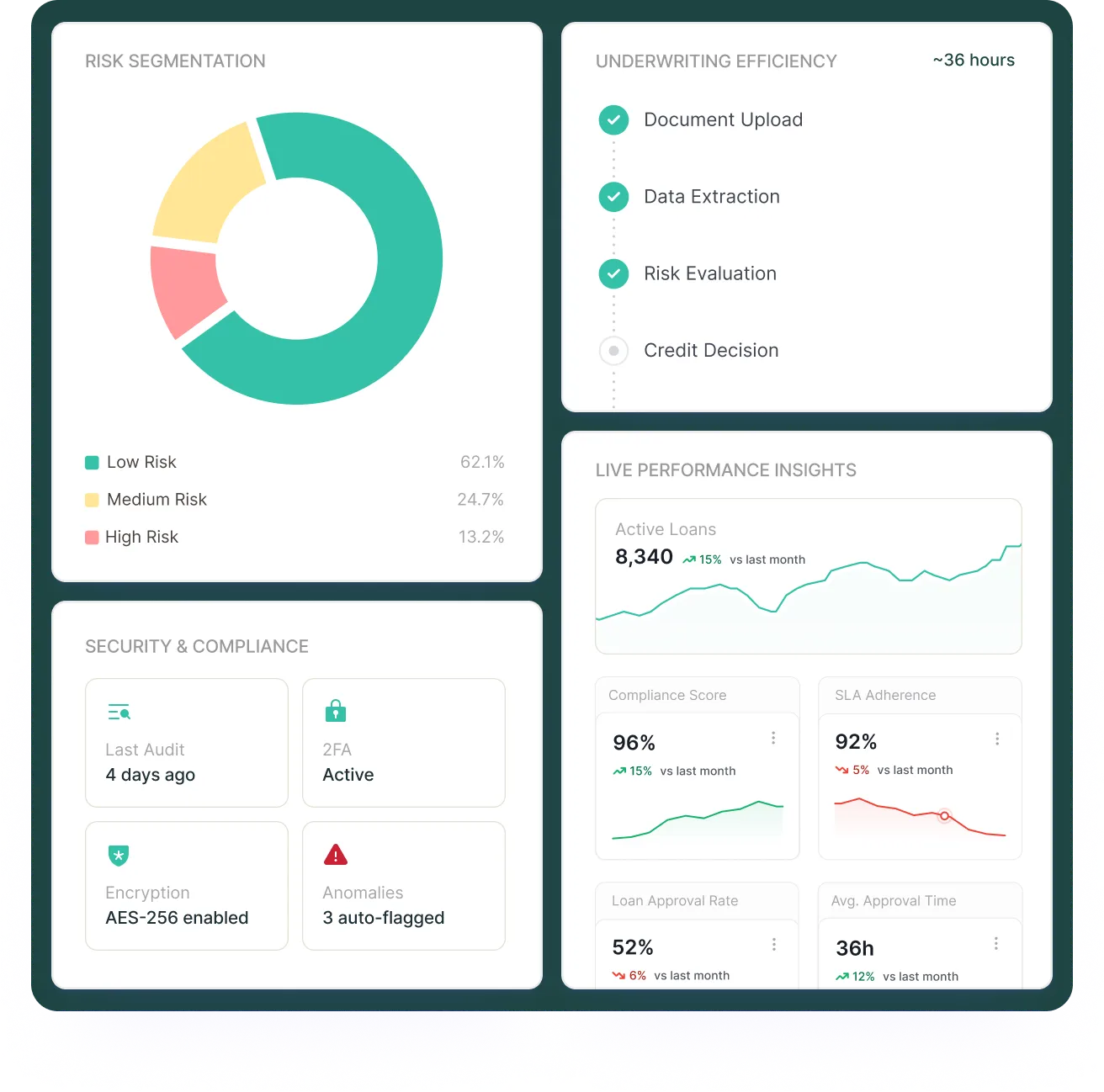

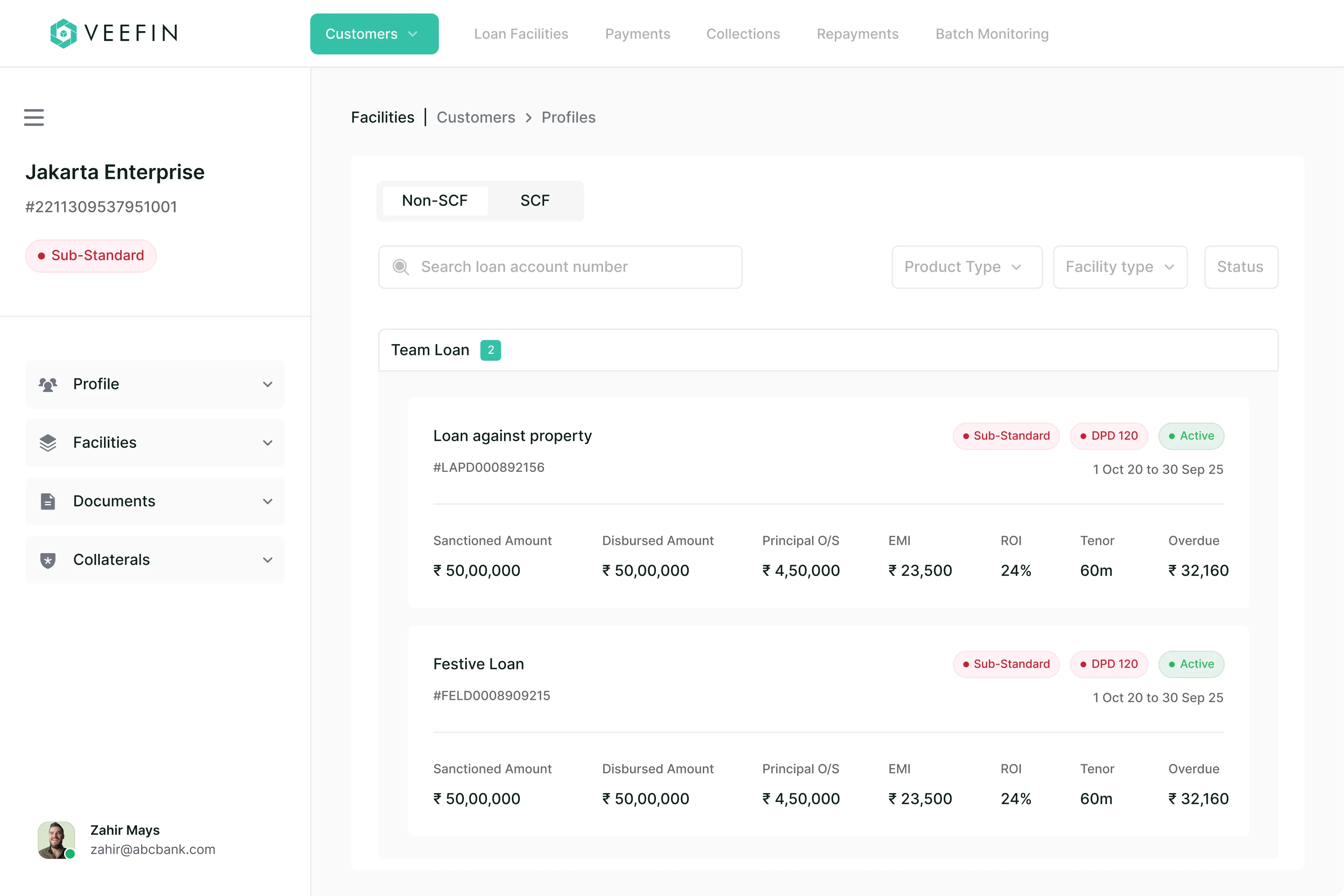

Technology - Enhanced Underwriting

Our technology foundation powers the entire securitization ecosystem.

Automated Risk Assessment

Data-driven algorithms evaluate vendor quality and segment portfolios by risk parameters

Process Efficiency

Streamlined operations reduce costs and accelerate timelines from weeks to days

Enhanced Security

Multi-layer risk controls and continuous portfolio monitoring protect all stakeholders

Real-Time Insights

Comprehensive dashboards provide full visibility into performance metrics

.png)

A New Asset Class

Experience the

Veefin Difference

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Frequently Asked Questions

What makes dealer receivables an attractive asset class for investors?

Dealer receivables offer several advantages as an investment asset class. They provide exposure to India's growing MSME sector while delivering attractive yields compared to traditional fixed-income investments. Our structured approach creates credit-rated Pass-Through Certificates with prioritized payment waterfall and credit enhancements, balancing yield with protection. The short-term nature of trade receivables (typically 90 days) enables relatively quick cash flow generation while our replenishment mechanism extends instrument tenor to 12 months for sustainable investment periods.

How does your securitization process work?

Our platform features persona-driven, journey-based interfaces that adapt to different user roles instead of the traditional field-based forms found in legacy systems. Users can customize their experience with widget-based dashboards, while our repository of widgets allows for mix-and-match configurations based on individual preferences. This approach dramatically improves user adoption and productivity while reducing training requirements.

What criteria do receivables need to meet to be included in your securitization pools?

Veefin's Trade Finance platform serves as a catalyst for digital transformation by providing a modern, flexible foundation that can evolve with changing business needs. Our API-first architecture enables seamless integration with fintech innovations, marketplace participation, and open banking initiatives. The composable nature of our platform allows banks to modernize incrementally, replacing specific components while maintaining business continuity.

How does recent regulatory evolution impact securitization investments?

Implementation timelines vary based on scope, but our modular approach allows for phased deployments that deliver value quickly. Typical implementations range from 6-18 months depending on the number of modules and complexity of integrations. Our multi-entity capability allows global banks to deploy a single instance across multiple countries, significantly reducing the time and cost compared to traditional country-by-country implementations.

What types of financial institutions typically invest in your securitized products?

Our multi-entity architecture allows banks to consolidate multiple country operations on a single platform, reducing infrastructure, maintenance, and support costs. The persona-driven self-service capabilities reduce dependency on relationship managers and customer support staff. Additionally, our low-code customization toolkit minimizes reliance on expensive third-party vendors for customizations and enhancements.

.svg)

.svg)

.svg)

.svg)

.svg)